Top-Rated Insurance for Modern Smart Homes: Ensuring Comprehensive Coverage for the Connected Era

Top-Rated Insurance for Modern Smart Homes sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with a focus on providing top-notch insurance for the latest smart home technologies.

As we delve into the world of modern smart homes and the specialized insurance coverage they require, readers will uncover key insights that illuminate the importance of tailored insurance plans in this digital age.

Overview of Top-Rated Insurance for Modern Smart Homes

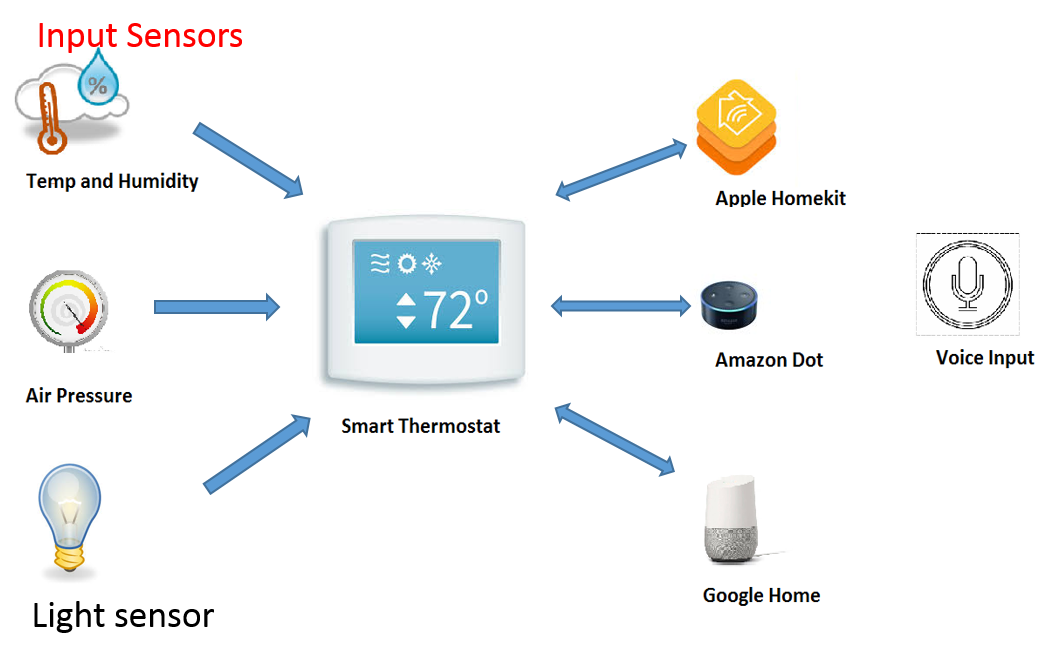

Modern smart homes are residences equipped with a range of interconnected devices and systems that can be remotely controlled and monitored through a smartphone or other networked devices. These devices can include smart thermostats, security cameras, door locks, lighting, and more.

In the context of insurance coverage, specialized policies are essential to protect these valuable assets and the unique risks associated with smart home technology.

Importance of Specialized Insurance for Smart Homes

Having specialized insurance for smart homes is crucial due to the increased risks and complexities involved in protecting these advanced technologies. Traditional home insurance policies may not adequately cover the high-tech gadgets and systems found in smart homes, leaving homeowners vulnerable to potential losses in case of malfunctions, cyber-attacks, or other related incidents.

Key Features of Top-Rated Insurance Plans for Modern Smart Homes

- Comprehensive Coverage: Top-rated insurance plans for smart homes offer comprehensive coverage for a wide range of risks, including damage to smart devices, data breaches, and cyber-attacks.

- Cybersecurity Protection: These insurance policies often include coverage for cybersecurity threats, such as hacking or malware attacks that can compromise the security of smart home systems.

- Equipment Replacement: In the event of damage or malfunction, top-rated insurance plans typically provide coverage for the repair or replacement of smart devices and systems.

- Remote Monitoring: Some insurance companies offer the ability to remotely monitor smart home systems to detect potential issues and prevent costly damages.

- Premium Discounts: Insurers may offer discounts on premiums for homeowners with smart home technology installed, as these devices can enhance security and reduce risks.

Coverage Options for Smart Home Insurance

When it comes to insuring modern smart homes, there are several coverage options available to protect homeowners from various risks and uncertainties. Let's explore the different types of coverage options and compare them with traditional home insurance policies.

Smart Home Coverage Options

- Smart Device Protection: This coverage option specifically insures smart devices, such as security cameras, smart thermostats, and virtual assistants, against damage, theft, or malfunctions.

- Cybersecurity Coverage: With the increasing prevalence of smart home hacks, cybersecurity coverage helps protect homeowners from cyber threats and data breaches related to their smart home systems.

- Home Automation System Coverage: This option covers the repair or replacement costs of the central hub that controls all smart devices in the home in case of damage or malfunction.

Comparison with Traditional Home Insurance

Unlike traditional home insurance, smart home insurance policies offer specialized coverage tailored to the unique risks associated with smart technologies. While traditional policies may cover basic damages like fire or theft, smart home insurance provides protection specifically for smart devices and cybersecurity threats.

Beneficial Scenarios for Smart Home Coverage Options

-

Example 1:

If a cybercriminal gains access to a homeowner's smart home system and compromises sensitive personal information, cybersecurity coverage can help cover the costs of investigating the breach and restoring security measures.

-

Example 2:

In the event of a malfunction in the home automation system that leads to a power surge damaging multiple smart devices, home automation system coverage can assist in repairing or replacing the central hub and affected devices.

Factors Influencing Top Ratings in Smart Home Insurance

When it comes to determining the top ratings for smart home insurance plans, insurance companies take several factors into consideration. These factors play a crucial role in assessing the level of risk associated with insuring a modern smart home

Impact of Smart Home Technology Advancements

As smart home technology continues to advance, insurance coverage and ratings are directly impacted. The integration of IoT devices, automation systems, and other smart features in homes can enhance security and reduce the risk of potential damages.

Security Features and IoT Devices

- Insurance companies often offer discounts for smart homes equipped with advanced security features such as smart cameras, motion sensors, and smart locks. These devices not only deter intruders but also provide valuable data for insurance companies to assess risks.

- IoT devices like smart leak detectors and smoke detectors can help prevent disasters like water damage or fires. This proactive approach to risk mitigation can lead to lower insurance premiums and higher ratings for smart home insurance plans.

Automation Systems and Insurance Premiums

- Automation systems that control lighting, heating, and other home functions remotely can improve energy efficiency and reduce the likelihood of accidents or damages. Insurance companies view these systems favorably, potentially resulting in lower premiums for smart home owners.

- Remote monitoring capabilities offered by automation systems allow homeowners to stay informed about their property's status, enabling quick responses to potential threats. This proactive monitoring can lead to better risk management and ultimately impact insurance ratings positively.

Choosing the Best Insurance Provider for Smart Homes

When selecting an insurance provider for your smart home, there are several important criteria to consider to ensure you get the best coverage for your needs. It's essential to research and compare different insurance companies offering coverage for modern smart homes to make an informed decision.

Researching and Comparing Insurance Companies

- Start by researching insurance companies that specialize in smart home coverage.

- Check the reputation and financial stability of each insurance provider.

- Compare the coverage options, deductibles, and premiums offered by different companies.

- Read reviews and testimonials from customers to gauge their satisfaction with the company's services.

Reading Policy Details and Understanding Coverage Limitations

- Thoroughly read the policy details to understand what is covered and excluded in the insurance plan.

- Pay attention to coverage limitations, such as the maximum coverage amount for smart devices or specific types of damages.

- Ask questions and seek clarification from the insurance provider if you are unsure about any aspect of the policy.

- Make sure you understand the claims process and the steps you need to take in case of damage or loss.

Summary

In conclusion, Top-Rated Insurance for Modern Smart Homes not only safeguards your valuable investments but also provides peace of mind in a rapidly evolving technological landscape. By understanding the intricacies of smart home insurance, homeowners can make informed decisions to protect their homes and loved ones.

FAQ Corner

What are the key features that make insurance plans top-rated for modern smart homes?

Top-rated insurance for modern smart homes typically includes coverage for smart devices, cyber threats, and personalized protection for high-tech equipment.

How do smart home technology advancements impact insurance coverage and ratings?

Advancements in smart home tech can lead to discounts on insurance premiums due to increased security measures and reduced risks of damage.

What criteria should individuals consider when selecting an insurance provider for their smart homes?

Factors to consider include coverage options, policy details, customer service, and the provider's reputation in handling smart home claims.