How to Get the Cheapest Auto Insurance Quote Without Hidden Fees

Starting off with How to Get the Cheapest Auto Insurance Quote Without Hidden Fees, this introductory paragraph aims to grab the attention of readers by providing an overview of the topic in a captivating manner.

The subsequent paragraph will delve into the specifics of the topic, offering detailed insights and valuable information.

Researching Auto Insurance Providers

When looking for the cheapest auto insurance quote without hidden fees, it is crucial to start by researching reputable auto insurance providers known for offering competitive rates. This step is essential to ensure you are dealing with a trustworthy company that will provide you with the coverage you need at a price you can afford.

Identify Reputable Auto Insurance Companies

- Check customer reviews and ratings to ensure the company has a good track record.

- Look for companies with a strong financial standing and a history of reliable customer service.

- Consider well-known national providers as well as local or regional insurance companies.

Utilize Comparison Websites

- Use comparison websites to get quotes from multiple providers simultaneously.

- Provide accurate information about your vehicle and driving history to receive the most accurate quotes.

- Compare the coverage options, deductibles, and premiums offered by each provider to find the best deal.

Factors Affecting Auto Insurance Quotes

When it comes to auto insurance quotes, there are several factors that can influence the rates you are offered. Understanding these factors can help you make informed decisions to potentially lower your insurance costs.

Age, Driving Record, and Type of Vehicle

- Your age can play a significant role in determining your auto insurance premium. Younger drivers are typically charged higher rates due to their lack of driving experience and higher likelihood of being involved in accidents.

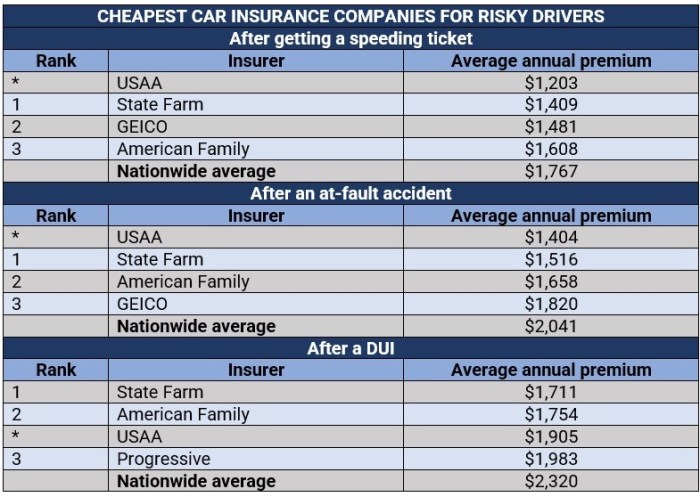

- Your driving record, including any past accidents or traffic violations, can also impact your insurance rates. A clean driving record with no accidents or tickets will usually result in lower premiums.

- The type of vehicle you drive can also affect your insurance costs. Insurance companies consider factors such as the make and model of your car, its safety features, and its likelihood of being stolen when calculating your premium.

Bundling Policies and Opting for a Higher Deductible

- Bundling your auto insurance policy with other types of insurance, such as homeowners or renters insurance, can often lead to discounts on your premiums. This is because insurance companies value customer loyalty and are more likely to offer lower rates to customers who have multiple policies with them.

- Opting for a higher deductible, the amount you pay out of pocket in the event of a claim, can also help lower your insurance costs. While a higher deductible means you'll have to pay more if you need to make a claim, it typically results in lower monthly premiums.

Significance of Maintaining a Good Credit Score

- Having a good credit score can also impact the auto insurance quotes you receive. Insurance companies often use credit scores as a factor in determining premiums, as studies have shown that individuals with higher credit scores are less likely to file insurance claims.

- By maintaining a good credit score, you can potentially qualify for cheaper insurance premiums and save money on your auto insurance policy.

Understanding Coverage Options

When it comes to auto insurance, understanding the different coverage options available is crucial in making the right choice for your needs. Let's compare the types of coverage options like liability, collision, and comprehensive insurance, discussing the pros and cons of each to help you make an informed decision.

Liability Insurance

- Liability insurance covers damages and injuries you cause to others in an accident.

- It is typically required by law and helps protect your assets in case you are sued for damages.

- However, it does not cover your own vehicle damage or injuries.

Collision Insurance

- Collision insurance covers damages to your vehicle in case of a collision with another vehicle or object.

- It can be beneficial if you have a new or expensive car that would be costly to repair or replace.

- Keep in mind that collision insurance may not be necessary for older or lower-value vehicles.

Comprehensive Insurance

- Comprehensive insurance covers damages to your vehicle from non-collision incidents like theft, vandalism, or natural disasters.

- It provides added protection for a wide range of risks that are beyond your control.

- Consider comprehensive insurance if you want peace of mind knowing your vehicle is protected in various scenarios.

Avoiding Hidden Fees in Auto Insurance Quotes

When obtaining auto insurance quotes, it is crucial to be aware of potential hidden fees that may not be immediately evident. These fees can significantly impact the overall cost of your policy. By understanding common hidden fees and how to spot them, you can make more informed decisions and potentially save money on your auto insurance.

Common Hidden Fees in Auto Insurance Quotes

- Processing Fees: Some insurance providers may charge processing fees for setting up your policy or making changes to it.

- Administrative Charges: These fees cover the administrative costs of managing your policy and may be included in your premium.

- Policy Fees: Certain insurers may impose policy fees for issuing and maintaining your policy documents.

- Installment Fees: If you choose to pay your premium in installments, you may incur additional fees.

Spotting Hidden Fees in Auto Insurance Quotes

- Review Policy Documents: Carefully read through the policy documents provided by the insurance company to identify any potential hidden fees.

- Ask Questions: Don't hesitate to ask your insurance provider about any fees that are not clearly Artikeld in the quote.

- Compare Quotes: Obtain quotes from multiple insurers and compare them side by side to look for discrepancies in fees.

Negotiating to Waive or Reduce Hidden Fees

- Request Waivers: When discussing your policy with the insurance provider, inquire about the possibility of waiving certain fees.

- Bundling Discounts: Some insurers offer discounts for bundling multiple policies together, which can help offset hidden fees.

- Good Driving Record: Maintaining a clean driving record can sometimes lead to lower fees or discounts on your auto insurance.

Closure

Concluding the discussion on How to Get the Cheapest Auto Insurance Quote Without Hidden Fees, this final paragraph will summarize key points and leave readers with a lasting impression.

Questions and Answers

What factors can affect auto insurance quotes?

Various factors like age, driving record, and type of vehicle can influence auto insurance rates.

How can I avoid hidden fees in auto insurance quotes?

To avoid hidden fees, carefully review policy documents and negotiate with providers to waive or reduce fees.

Why is maintaining a good credit score important for cheaper insurance premiums?

Maintaining a good credit score is crucial as it can help qualify for lower insurance premiums.