Home-Based Ecommerce Store Insurance Guide: Protecting Your Online Business

Delve into the world of home-based ecommerce store insurance with this comprehensive guide. Explore the risks, coverage options, and tips for choosing the right insurance provider to safeguard your business.

Learn about the different types of insurance needed, from general liability to cyber liability, and discover how to manage insurance costs effectively.

Importance of Insurance for Home-Based Ecommerce Stores

Operating a home-based ecommerce store comes with its own set of risks, despite the convenience and flexibility it offers. From potential product liabilities to cyber threats, there are various factors that can pose a threat to the smooth functioning of your business.Insurance plays a crucial role in protecting your home-based ecommerce business from these risks.

It provides financial security and peace of mind, ensuring that you are covered in case of unexpected events or incidents that could potentially disrupt your operations or lead to financial loss.

Risks Associated with Home-Based Ecommerce Stores

- Lack of physical security for inventory

- Data breaches and cyber attacks

- Product liability issues

- Business interruption due to unforeseen events

Types of Insurance Coverage Needed

When it comes to insurance for home-based ecommerce operations, there are several types of coverage that you should consider:

- Business Property Insurance:to protect your inventory, equipment, and other business assets.

- General Liability Insurance:to cover third-party bodily injury or property damage claims.

- Product Liability Insurance:to protect against claims related to products sold through your store.

- Cyber Liability Insurance:to safeguard against data breaches and cyber attacks.

- Business Interruption Insurance:to provide coverage for lost income in case your operations are temporarily halted.

Types of Insurance Coverage

Insurance coverage is crucial for home-based ecommerce stores to protect them from various risks. There are several types of insurance policies available for such businesses, each serving a specific purpose. Let's explore the main categories of insurance coverage for home-based ecommerce stores.

General Liability Insurance

General liability insurance provides coverage for claims of bodily injury, property damage, and advertising injury that may occur on your business premises or as a result of your business operations. This type of insurance can help cover legal fees, settlements, and medical expenses if a customer or third party is injured or their property is damaged while interacting with your business.

Product Liability Insurance

Product liability insurance is essential for home-based ecommerce stores that sell physical products. This type of insurance protects your business from legal claims related to product defects, design flaws, or inadequate warnings. If a customer is harmed by a product you sell, product liability insurance can help cover legal expenses, settlements, and damages.

Business Property Insurance

Business property insurance provides coverage for the physical assets of your home-based ecommerce store, such as inventory, equipment, and furniture. This insurance can help repair or replace these assets if they are damaged or destroyed due to covered perils like fire, theft, or natural disasters.

Cyber Liability Insurance

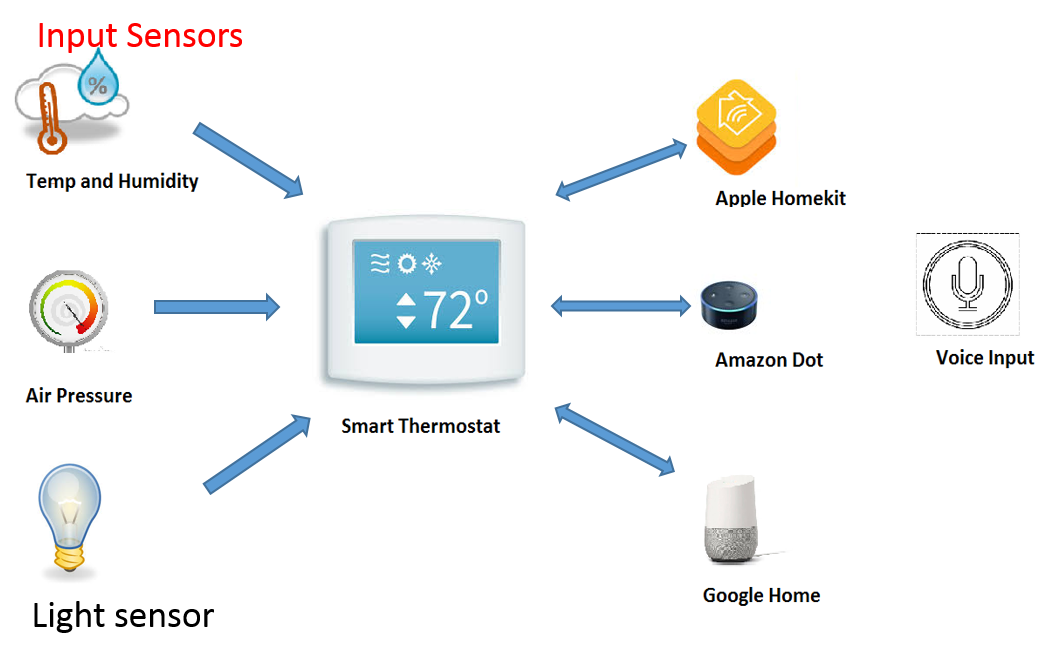

Cyber liability insurance is crucial for home-based ecommerce stores that operate online. This type of insurance protects your business from cyber threats, such as data breaches, hacking, and cyber extortion. Cyber liability insurance can help cover the costs associated with notifying customers of a data breach, restoring data, and legal expenses related to cyber incidents.

Choosing the Right Insurance Provider

When it comes to protecting your home-based ecommerce store, choosing the right insurance provider is crucial. Here are some tips for selecting a reputable insurance provider and understanding the factors to consider when comparing insurance quotes and coverage options.

Research and Compare

- Research different insurance providers that specialize in coverage for home-based businesses.

- Compare the coverage options, premiums, deductibles, and customer reviews of each provider.

- Look for providers with experience in the ecommerce industry to ensure they understand the unique risks involved.

Check Financial Stability

- Verify the financial stability of the insurance provider by checking their ratings from independent agencies like A.M. Best or Standard & Poor's.

- Ensure the provider has the financial resources to pay out claims in case of any incidents affecting your business.

Read the Fine Print

- Review the policy exclusions, limitations, and conditions to fully understand what is covered and what is not.

- Pay attention to details such as coverage limits, liability protection, and any additional endorsements or riders that may be needed.

- Ask questions and seek clarification on any aspects of the policy that are unclear before making a decision.

Cost of Insurance

When it comes to insuring your home-based ecommerce store, the cost of insurance premiums can vary depending on several factors. Understanding what influences these costs and how to reduce them without compromising coverage is crucial for the financial health of your business.

Factors Influencing Insurance Costs

- The value of your inventory and equipment: The more valuable items you have in your store, the higher your insurance premiums are likely to be. Make sure to accurately assess the value of your assets to determine the appropriate coverage.

- Location of your home-based business: If your business is located in an area prone to natural disasters or high crime rates, you may face higher insurance costs to mitigate these risks.

- Previous claims history: A history of frequent claims or high-value claims can lead to increased premiums as insurers view your business as a higher risk.

Strategies for Reducing Insurance Costs

- Implement risk management practices: By taking steps to reduce the risks associated with your business, such as installing security systems or fire alarms, you can potentially lower your insurance premiums.

- Shop around for quotes: Don't settle for the first insurance provider you come across. Compare quotes from different insurers to find the best coverage at the most competitive price.

- Bundle policies: Some insurers offer discounts if you purchase multiple policies from them, such as combining your business insurance with your home insurance.

Long-Term Financial Benefits

- Peace of mind: Knowing that your business is protected by comprehensive insurance coverage can provide peace of mind and allow you to focus on growing your business without worrying about potential financial losses.

- Financial security: In the event of a covered loss, having insurance can help your business recover and continue operating without facing significant financial setbacks.

- Legal protection: Insurance can also protect your business from potential lawsuits or liability claims, safeguarding your personal assets and reputation.

Final Summary

Wrap up your journey through the ins and outs of home-based ecommerce store insurance with a succinct summary that highlights the key takeaways and emphasizes the importance of protecting your online venture.

FAQ Corner

What are the risks associated with operating a home-based ecommerce store?

Risks can include theft, property damage, and liability for injuries on your premises.

How can I reduce insurance costs for my home-based ecommerce store?

You can bundle policies, increase deductibles, and implement risk management practices to lower costs.

Why is cyber liability insurance important for online businesses?

Cyber liability insurance protects against data breaches, cyber attacks, and other online risks that can impact your business.