Does AT&T Digital Life Affect Homeowners Insurance?

Exploring the impact of AT&T Digital Life on homeowners insurance unveils a realm of possibilities and considerations. Let's delve into how this innovative technology may influence your insurance coverage and premiums.

As we navigate through the intricacies of AT&T Digital Life and homeowners insurance, intriguing insights await to shed light on this evolving relationship.

How AT&T Digital Life affects homeowners insurance?

AT&T Digital Life, a smart home security system, can have an impact on homeowners insurance premiums due to the added level of security it provides. Insurance companies may view homes equipped with AT&T Digital Life as less risky, potentially leading to lower insurance rates for homeowners.

Potential Impact on Insurance Premiums

- Insurance companies may offer discounts for homeowners who have a monitored security system like AT&T Digital Life installed in their homes.

- By reducing the risk of burglary or damage, AT&T Digital Life can potentially lower the likelihood of insurance claims, leading to lower premiums.

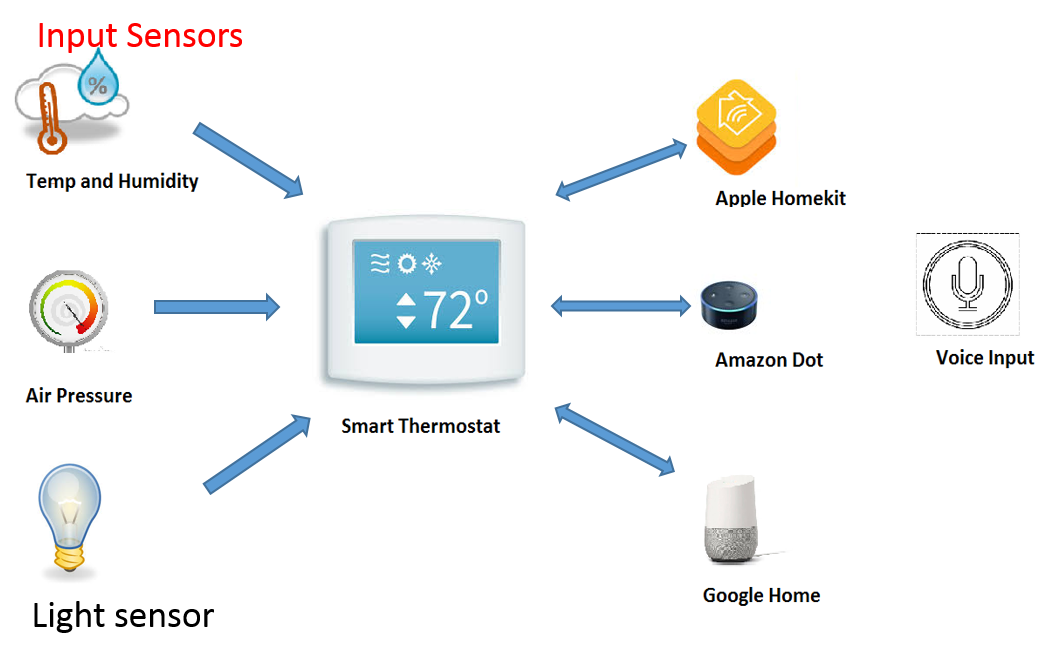

Specific Features of AT&T Digital Life

- 24/7 professional monitoring for security breaches or emergencies.

- Remote access to monitor and control home security systems through a mobile app.

- Integration with smart home devices for added convenience and security.

Discounts and Benefits for Homeowners

- Some insurance companies offer specific discounts for homeowners who have a monitored security system like AT&T Digital Life.

- Homeowners may receive additional benefits such as faster response times from emergency services in case of a security breach.

Factors to consider when assessing the impact of AT&T Digital Life on homeowners insurance.

When evaluating the impact of AT&T Digital Life on homeowners insurance, several factors come into play. Insurance companies take various elements into consideration to determine how the presence of AT&T Digital Life security systems affects coverage and premiums.

Elements insurance companies may consider when evaluating the use of AT&T Digital Life:

- The type of security devices installed: Insurance providers may assess the specific security devices included in the AT&T Digital Life system, such as cameras, motion sensors, and smart locks, to gauge the level of protection offered.

- The monitoring services utilized: Insurance companies may inquire about whether professional monitoring services are part of the AT&T Digital Life package, as continuous monitoring can enhance security and decrease the risk of incidents.

- The integration with emergency services: Integration with emergency services like police or fire departments can impact insurance evaluations, as quick response times can minimize damages in case of emergencies.

How the level of home security provided by AT&T Digital Life can affect insurance coverage:

- Increased security measures can lead to lower premiums: Insurance companies often offer discounts for homeowners with advanced security systems like AT&T Digital Life, as these systems reduce the likelihood of theft or damage.

- Potential for faster claims processing: In the event of a security breach or incident, having a monitored security system like AT&T Digital Life can provide clear evidence and documentation, facilitating faster claims processing.

Insights on how insurance policies may be adjusted based on the presence of AT&T Digital Life security systems:

- Premium discounts: Insurance providers may offer reduced premiums or discounts to homeowners who have AT&T Digital Life installed, reflecting the improved security and decreased risk associated with these systems.

- Policy enhancements: Some insurance companies may offer additional coverage or benefits to policyholders with advanced security systems like AT&T Digital Life, providing added peace of mind and protection.

Comparing insurance coverage for homes with and without AT&T Digital Life.

When it comes to homeowners insurance, the presence of AT&T Digital Life can have a significant impact on both coverage options and premiums. Let's delve into the details of how insurance coverage differs between homes with and without AT&T Digital Life.

Insurance Premiums Comparison

- Homes with AT&T Digital Life: With the added security features provided by AT&T Digital Life, such as smart home monitoring and automation, homeowners may be eligible for discounts on their insurance premiums. Insurance companies often view these additional security measures as risk-reducing factors, leading to potential cost savings for homeowners.

- Homes without AT&T Digital Life: On the other hand, homes without smart home security systems like AT&T Digital Life may not benefit from the same level of discounts on insurance premiums. Insurance companies may consider these homes to be at a higher risk for burglary or property damage, potentially resulting in higher premiums.

Differences in Coverage Options

- Homes with AT&T Digital Life: Homeowners with AT&T Digital Life may have access to additional coverage options or endorsements specifically tailored to smart home security systems. This could include coverage for equipment malfunctions, cyber attacks, or identity theft related to the smart home technology.

- Homes without AT&T Digital Life: Without smart home security systems like AT&T Digital Life, homeowners may not have the option to add these specialized endorsements to their insurance policies. This could leave them vulnerable to potential risks associated with smart home technology.

Potential Insurance Savings with AT&T Digital Life

- Scenario 1: A homeowner installs AT&T Digital Life and experiences a decrease in burglary incidents due to enhanced security measures. As a result, the insurance company may reduce the homeowner's premiums, reflecting the reduced risk of property loss.

- Scenario 2: In the event of a break-in, the smart home monitoring capabilities of AT&T Digital Life alert authorities promptly, minimizing the extent of property damage. This proactive response could lead to insurance cost savings by preventing more extensive claims.

Best practices for homeowners utilizing AT&T Digital Life for insurance purposes.

When it comes to maximizing insurance benefits with AT&T Digital Life, homeowners should follow specific steps to ensure they are leveraging their security setup effectively.

Effective Communication with Insurance Providers

- Regularly update your insurance provider about your AT&T Digital Life security system to ensure they are aware of the added protection in your home.

- Provide detailed information about the features and capabilities of your security system to help insurance providers understand the extent of your home's security measures.

- Keep records of any communication with your insurance provider regarding your security system to have a documented history of the information shared.

Maximizing Insurance Benefits with AT&T Digital Life

- Ensure that all entry points in your home are covered by the security system to maximize protection and potential insurance discounts.

- Regularly test and maintain your security system to guarantee it is functioning correctly and providing the intended level of security for your home.

- Review your insurance policy regularly to understand how your security system may impact coverage and discounts provided by your insurance provider.

Checklist for Optimizing Insurance Coverage with AT&T Digital Life

- Verify that all sensors, cameras, and alarms are properly installed and connected to the AT&T Digital Life system.

- Confirm that your security system is monitored 24/7 to ensure immediate response in case of emergencies or security breaches.

- Discuss with your insurance provider the specific features of your security system that may qualify you for discounts on your homeowners insurance policy.

Final Review

In conclusion, the intersection of AT&T Digital Life and homeowners insurance opens doors to new perspectives and potential savings. By understanding the nuances of this connection, homeowners can make informed decisions to protect their homes and loved ones effectively.

General Inquiries

How does using AT&T Digital Life impact homeowners insurance premiums?

Using AT&T Digital Life may potentially lead to discounts on homeowners insurance premiums due to enhanced security measures.

What specific features of AT&T Digital Life can influence insurance rates?

Features like smart sensors, surveillance cameras, and remote monitoring capabilities can impact insurance rates positively.

Are there any benefits or discounts for homeowners using AT&T Digital Life in relation to insurance?

Homeowners using AT&T Digital Life may receive discounts or incentives from insurance providers for investing in advanced security systems.